prince william county real estate tax payments

Median Property Taxes Mortgage 3893. How property tax calculated in pwc.

New Facility Will Grow Prince William County S Composting Capabilities News Prince William Insidenova Com

Include one or more special characters.

. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. Make a Quick Payment. Personal Property The Town of Visit Prince William County Finance Department online or call 703-792-6700 for information regarding available tax relief discount programs or exemptions.

The second and all subsequent installments are due on the 5th of each month with the final payment being due on June 5th. Ad Look Up Any Address in the USA. Provided by Prince William County.

Prince William County Real Estate Taxes Due July 15 2022. The first monthly installment is due July 15th. By mail to PO BOX 1600 Merrifield VA 22116.

Ad Pay Your Taxes Bill Online with doxo. When tax assessors estimate the value of your property they multiply that number by the tax rate of the county. What is different for each county and state is the property tax rate.

Be 6 characters or longer. Press 1 for Personal Property Tax. Follow These Steps to Pay by Telephone.

Payment by e-check is a free service. A convenience fee is added to payments by credit or debit card. Millions of Property Records Are Accessible to the Public.

The county proposes a new 4 meals tax to be charged at restaurants. Access to Other Accounts. Prince William County real estate taxes for the first half of 2020 are due on July 15 2020.

The extension applies to both commercial and residential real property. During a meeting on Nov. Click here to register for an account or here to login if you already have an account.

Include one or more uppercase characters. When are property taxes due in Virginia County Prince William. 17 2020 the Prince William Board of County Supervisors passed a resolution extending the payment deadline for real estate taxes for the second half of 2020 for 60 days.

Finding the Amount of Property Taxes Paid. Completed applications should be mailed to the Tax Administration Division at. Download Property Records from the State Assessors Office.

Treasurer Tax Collector Offices near Woodbridge. You can read more at Propety Taxes in. Report changes for individual accounts.

Prince William County collects on average 09 of a propertys assessed fair market value as property tax. Median Property Taxes No Mortgage 3767. Report a Change of Address.

If payment is late a 10 late payment penalty is assessed on the unpaid original tax balance. In Prince William County Virginia the tax rate is 105 which is. The Prince William County Department of Finance reminds residents that personal property taxes are due on or before Monday Oct.

Learn all about Prince William County real estate tax. -- Select Tax Type -- Bank Franchise Business License Business. Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143 counties in order of.

Make checks payable to Prince William County. Ferlazzo Building and McCoart Taxpayer Services Offices Monday Tuesday Thursday and Friday from. Occasionally the billing information on file is incorrect and a real estate tax bill that should have been sent to a mortgage services company is instead mailed to a property owner.

By phone at 1-888-272-9829 jurisdiction code 1036. Manage Access - Grant Revoke Account Access. All you need is your tax account number and your checkbook or credit card.

They pay back the previous owners at the juncture. Hi the county assesses a land value and an improvements value to get a total value. Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date.

Include one or more numbers. By mail to PO Box 70519 Philadelphia PA 19176-0519 and in person at the Sudley North Drive AJ. When prompted enter Jurisdiction Code 1036 for Prince William County.

The average homeowner will pay about 250 more in Real Estate taxes and fire levy taxes next year. Then they multiply that by the tax rate to get your property tax. Prince William County Property Tax Payments Annual Prince William County Virginia.

The deadline has been changed from Dec. Most homeowners pay their real estate taxes through a mortgage services company. You can pay a bill without logging in using this screen.

Dial 1-888-2PAY TAX 1-888-272-9829 using a touch tone telephone. Welcome to Prince William Countys Taxpayer Portal. Purchasers are now required to remit the tax.

The Board of County Supervisors reviewed. By creating an account you will have access to balance and account information notifications etc. The County bills and collects tax payments directly from these companies.

Use My Location Manassas. Then they get the assessed value by multiplying the percent of total value assesed currently 100. The Taxpayer Services in-person and.

5 2020 to Feb. The county assessed home. There are several convenient ways property owners may make payments.

Have pen paper and tax bill ready before calling. PERSONAL PROPERTY TAX PAYMENT AND PENALTY. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

Prince William County residents will face higher property taxes over the next 12 months with the average homeowner paying 172 more in Real Estate taxes. Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. This estimation determines how much youll pay.

You will need to create an account or login. Prince William County Tax Administration Division PO Box.

Prince William County Launches A New Show Called County Conversation

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

Deadline Extended To Pay Real Estate Taxes For Second Half Of 2020 Prince William Living

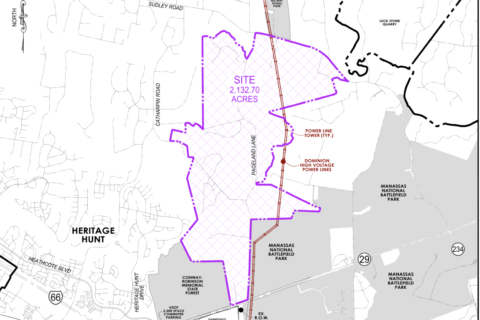

Qts Prince William Landowners Propose Massive Data Center Campus Washington Business Journal

Commanders Buy Land For Preferred Stadium Site In Nova Espn Report Woodbridge Va Patch

Data Center Opportunity Zone Overlay District Comprehensive Review

Prince William Wants To Hike Property Taxes Introduces Meals Tax

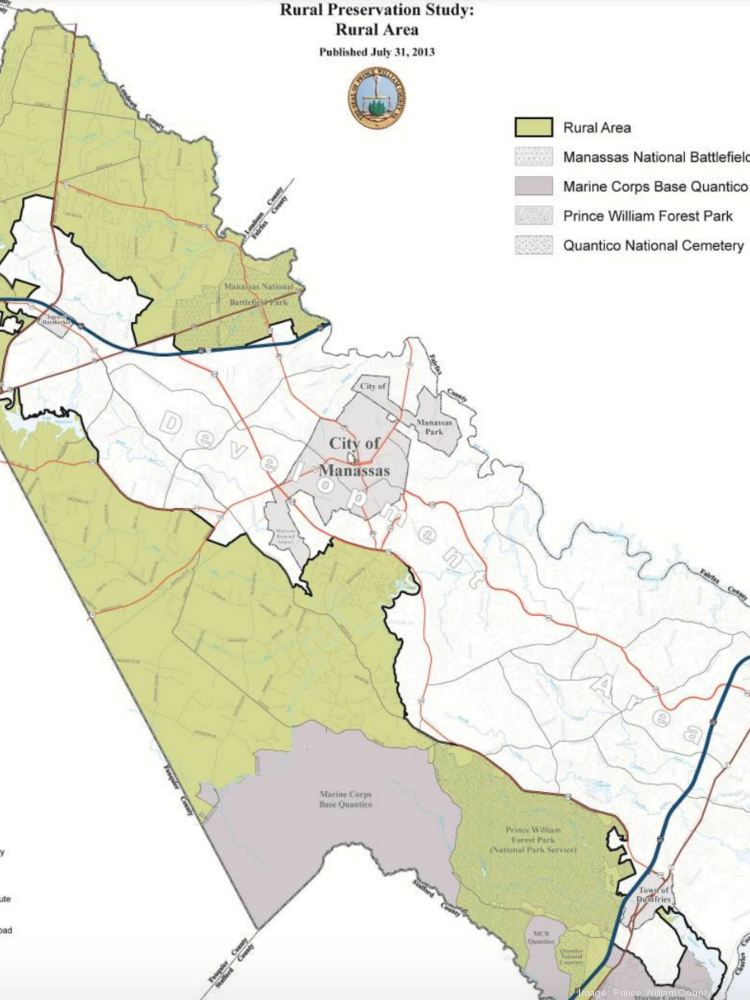

The Rural Area In Prince William County

Prince William Supervisors Set To Approve Tax Hikes For Residents Restaurant Customers Tuesday

Prince William Board Of County Supervisors Adopts Fy2023 Budget Prince William Living